Invest in Astrum Drive Aerospace

We are raising funds for in-orbit demonstration, the final step before commercial deployment of the Astrum Drive.

This mission will elevate the technology to TRL 9, and position Astrum Drive as the first commercially viable propellantless, electricity-only propulsion system in space.

In the space industry the orbital demonstration is a pivotal point. Companies such as Rocket Lab, Firefly Aerospace, Voyager Space, and Momentus all reached billion-dollar valuations after proving their hardware in orbit. For us, that moment is now.

Beyond transforming the $200B satellite propulsion market, this technology also opens the door to emerging multi-billion-dollar sectors such as space mining, space tourism, and life-extension retrofits for aging satellites.

What the Orbital Demonstration Will Validate

System behavior in sustained microgravity and vacuum.

Thermal and mechanical stability over long durations.

Scalability for operational satellite missions.

Use of Funds

Payload integration and flight preparation

Vacuum-optimized hardware and structural upgrades

Vibration and thermal improvements.

Orbital mission execution and post-flight data analysis.

Extend global patent coverage and strengthen IP protection.

Market & Commercial Potential

Satellite station-keeping and lifetime extension.

Orbital servicing, tug missions, and debris operations.

Deep-space and long-duration exploration missions.

Next-generation space logistics and infrastructure.

With propellant removed from the equation – spacecraft service life, maneuverability, and mission profiles are no longer constrained by fuel. This creates a new class of operational capability—and a major competitive advantage for operators adopting propellantless propulsion.

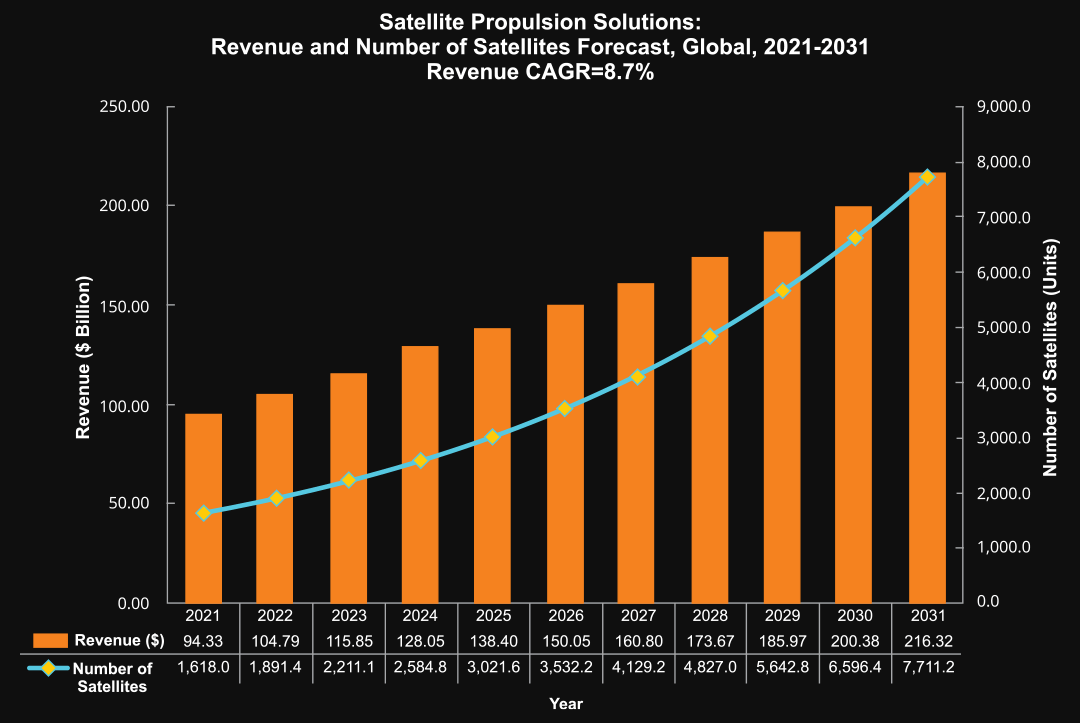

Market Opportunity and TAM

Revenue and Number of Satellite Forecast

Here’s the truth: there are no gas stations in space. Once a satellite runs out of fuel, it dies. With our system, that problem disappears forever. Fuel free propulsion is not just a better option—it’s the only one that ensures long-term operations in orbit.

Other Markets

| APPLICATION | ESTIMATED MARKET VALUE (USD) | TIME HORIZON | KEY PLAYERS / INDICATORS |

| 1. Satellite Life Extension (commercial & gov’t) | ~$2.4 B (2023) → ~$5.1 B (2030) (on-orbit servicing overall) | 2025–2030 | Northrop Grumman/SpaceLogistics (MEV/MEP), Intelsat, SES; 500+ GEO sats active |

| 2. Retrofits (propulsion modules) | Subset of above (multi-$100 M by 2030); analysts project multi-$B overall | 2025–2030 | Northrop SpaceLogistics (Mission Extension Pods); Intelsat, Optus deals |

| 3. Insurance Risk Reduction | ~$0.7 B (2024) → ~$0.9–1.0 B (2030) (total premiums); risk-mitigation services tens of $M/yr | 2025–2030 | Space insurers (Munich Re, AXA XL); rising premiums after ~$0.9 B claims in 2023 |

| 4. Deep Space Exploration & Tourism | NASA/space agency budgets ~$10–15 B/yr (e.g. Artemis ≈$53 B/5yr); Space tourism ≈$10 B by 2030 | 2025–2035 | NASA (Artemis, Moon/Mars missions); SpaceX, Blue Origin, Virgin Galactic; cruise spaceflight startups |

| 5. Asteroid Mining / Off-Earth Resources | ~$1.9 B (2024) → ~$5–9 B by ~2030 | 2025–2035 | Startups (ispace, Planetary Resources); NASA/ESA mining tech; government space agencies |

| 6. Defense (stealth propulsion, ISR) | Military satcom market ~$30 B (2023) (→ ~$50 B by 2032); technology portion ~$1–5 B | 2025–2035 | US Space Force/DARPA (maneuverable satellites R&D); Lockheed, Boeing; naval R&D (MHD drives) |

| 7. Emerging (HAPS, UUV, marine) | HAPS: ~$1.5 B (2023) → ~$2.7 B (2030); UUV: ~$4.8 B (2024) → ~$11 B (2030); Marine hybrid: ~$4 B (2023)→$10+B | 2025–2030 | HAPS: Airbus (Zephyr), Alphabet; Underwater: Naval research labs, AUV makers; Marine: shipbuilders, hybrid system vendors |

Compared to current systems, we offer:

3 times higher thrust per watt.

Lower launch costs and double the payload capacity, since no fuel is used or needs to be launched.

2 to 3 times longer mission durations.

Dynamic orbital maneuvering and the ability to evade threats.

| # | TECHNOLOGY | FORCE GENERATED (MILLINEWTONS) | SPECIFIC IMPULSE (SECONDS) | POWER REQUIRED (WATTS) | USAGE | TYPICAL SATELLITE WEIGHT |

| 1 | Hall Effect Thrusters (HET) | 100 to 500 | 1600 to 2200 | 1.5 kW to 4.5 kW | Station-keeping, orbit transfers, attitude control in larger satellites | 500 kg to 2,000 kg |

| 2 | Gridded Ion Thrusters | 25 to 250 | 3000 to 4500 | 1 kW to 7 kW | Deep space missions | 500 kg to 2,000 kg |

| 3 | Field Emission Electric Propulsion (FEEP) | A few micro-newton to about 1 |

8000 to 10000 | Less than 50W | Precise positioning and attitude control in small spacecraft and CubeSats |

1 kg to 50 kg |

| 4 | Pulsed Plasma Thrusters (PPT) | Tens to hundreds of micro-newtons per pulse | 1000 to 3000 | Tens of watts | Altitude adjustments and orbit corrections in small satellite missions | 10 kg to 100 kg |

| 5 | Electrothermal Thrusters (including resistojets and arcjets) | A few millinewtons to about 0.5 newtons | 500 to 1000 | Less than 100 W to over 1 kW | Satellite station-keeping and deorbit manoeuvres | 100 kg to 500 kg |

| 6 | Electrospray Thrusters | Micro-newton to milli-newton range | 1000 to 4000 | Generally very low, often just a few watts | Precise manoeuvring and positioning in small satellite applications |

1 kg to 10 kg |

| 7 | Propellantless space propulsion system (Astrum Drive) | 20 – 50 | Infinite | 300 W | Satellite maneuvering and orbit keeping, deep space missions | 1 kg – 10,000 kg |

| THRUSTER / ENGINE | TYPE | INPUT POWER | THRUST | THRUST-PER-KW |

| Astrum Drive | “Propellantless” electrical | 300 W | 50 mN | 167 mN/kW |

| Astra Spacecraft Engine (2-string) | Hall (Xe) | 800 W | ~50 mN | ~62.5 mN/kW |

| Busek BHT-200 | Hall (Xe/Kr) | 200 W | ~13 mN | ~65 mN/kW |

| Busek BHT-1500 | Hall (Xe/Kr) | 1.8 kW | ~103 mN | ~57 mN/kW |

| Safran PPS-1350 | Hall (Xe) | 1.5 kW | ~90 mN | ~60 mN/kW |

| ThrustMe NPT300 (R&D) | Gridded ion | 200–500 W | 8–12 mN | ~16–60 mN/kW |

| ThrustMe NPT30-I2 (flown) | Iodine ion | 55 W | ~0.8 mN | ~14.5 mN/kW |

| ENPULSION NANO R3 (max) | FEEP | ≤40 W | ≤0.35 mN | ≤8.8 mN/kW |

Financial Projections and Business Model

| DATE | ACHIEVEMENT / NEXT STEP |

| 2020 | Breakthrough and Provisional Patent. |

| 2021 | Raised $500,000 of Funding. |

| 2024 | Working prototype completed. Full US patent received. |

| 2025 – 2026 |

Working on the next generation of prototypes. |

| 2027 |

Space demonstration in the fall of 2027. |

| 2028 | Start the Sales with 100 units for the first year, which is over $50M+ in sales. |

Go to market in ~3 years.

We make money by licensing and selling propulsion modules to satellite providers, defense contractors, and government agencies

We project to sell 100 units for the first year at $0.3-3M per unit, in comparison ~3000 satellites and spacecrafts are launched every year.

We collaborate with experts from the following organizations

The orbital demo mission is the last step before commercialization, raising the Astrum Drive to TRL 9 and opening the gateway to deploying fuel-free propulsion across the space industry

If you are an investor, partner, or engineer shaping the future of space

We invite you to join us on this mission.

ASTRUM DRIVE

AEROSPACE

SITE MAP

Headquarters

Dallas TX, USA

CONTACT US

contact@astrumdrive.com